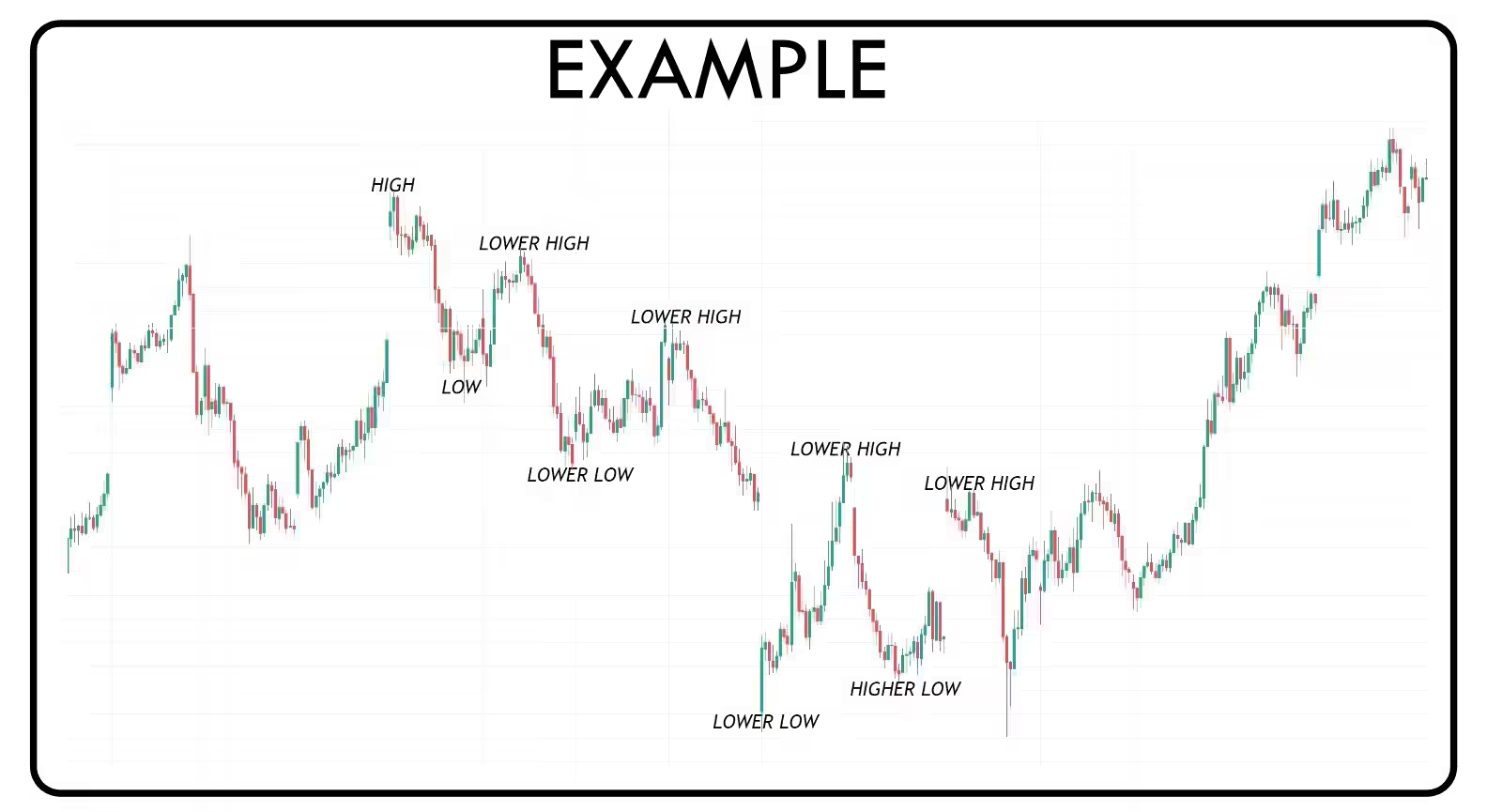

In the stock market, knowing whether prices are going up, down, or staying the same is very important. By looking at charts, we can understand these movements. Let’s learn about downtrend, uptrend, and consolidation, which are simple patterns in price charts

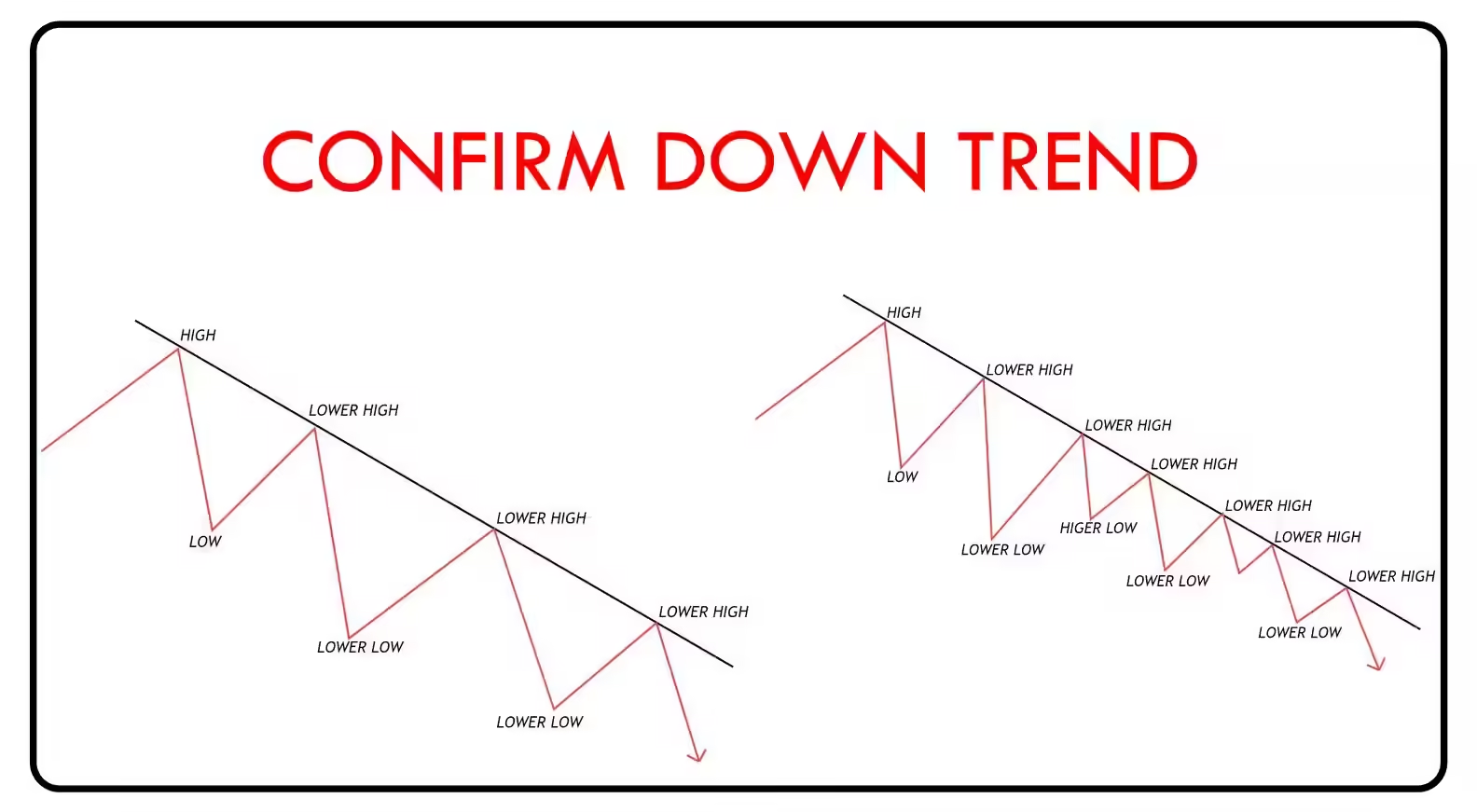

What is a Downtrend?

A downtrend is when the price of a stock or asset keeps going down over time. This means the stock is losing value, and sellers are stronger than buyers.

In a downtrend, there are two important things to notice:

- Lower Highs: Every time the price tries to go up, it doesn’t go as high as before.

- Lower Lows: Each time the price falls, it drops lower than before.

If we draw a line connecting the lower highs, we can see a clear downward slope. This is a signal that the stock is not doing well.

Simple Example:

What is an Uptrend?

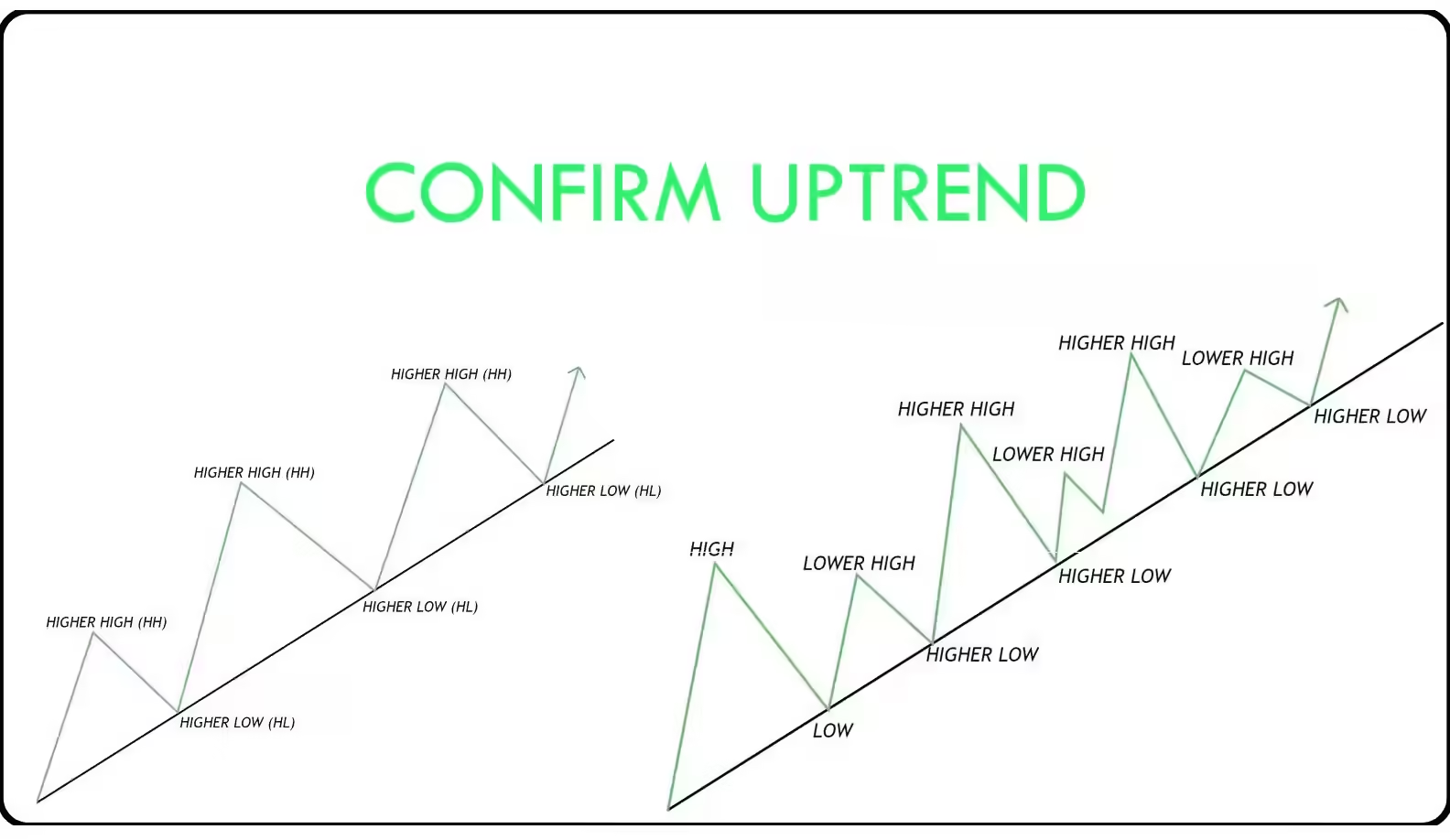

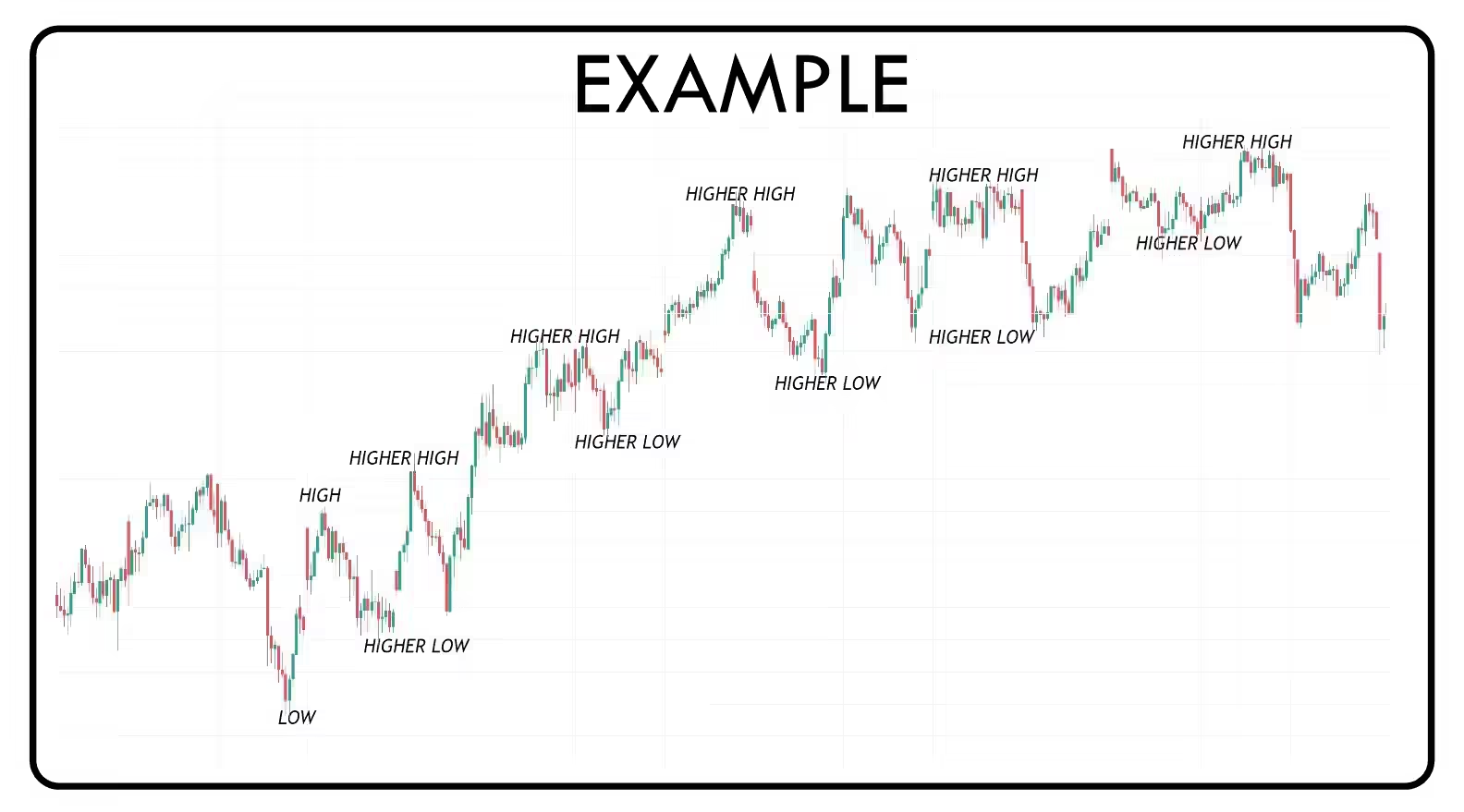

An uptrend is when the price of a stock keeps going up. This means the stock is gaining value, and buyers are stronger than sellers.

In an uptrend, there are two key things to look at:

- Higher Highs: Every time the price rises, it goes higher than before.

- Higher Lows: When the price drops a little, it doesn’t fall as low as it did the last time.

In this case, if you draw a line through the higher lows, it will slope upward, showing that the stock is doing well.

Simple Example:

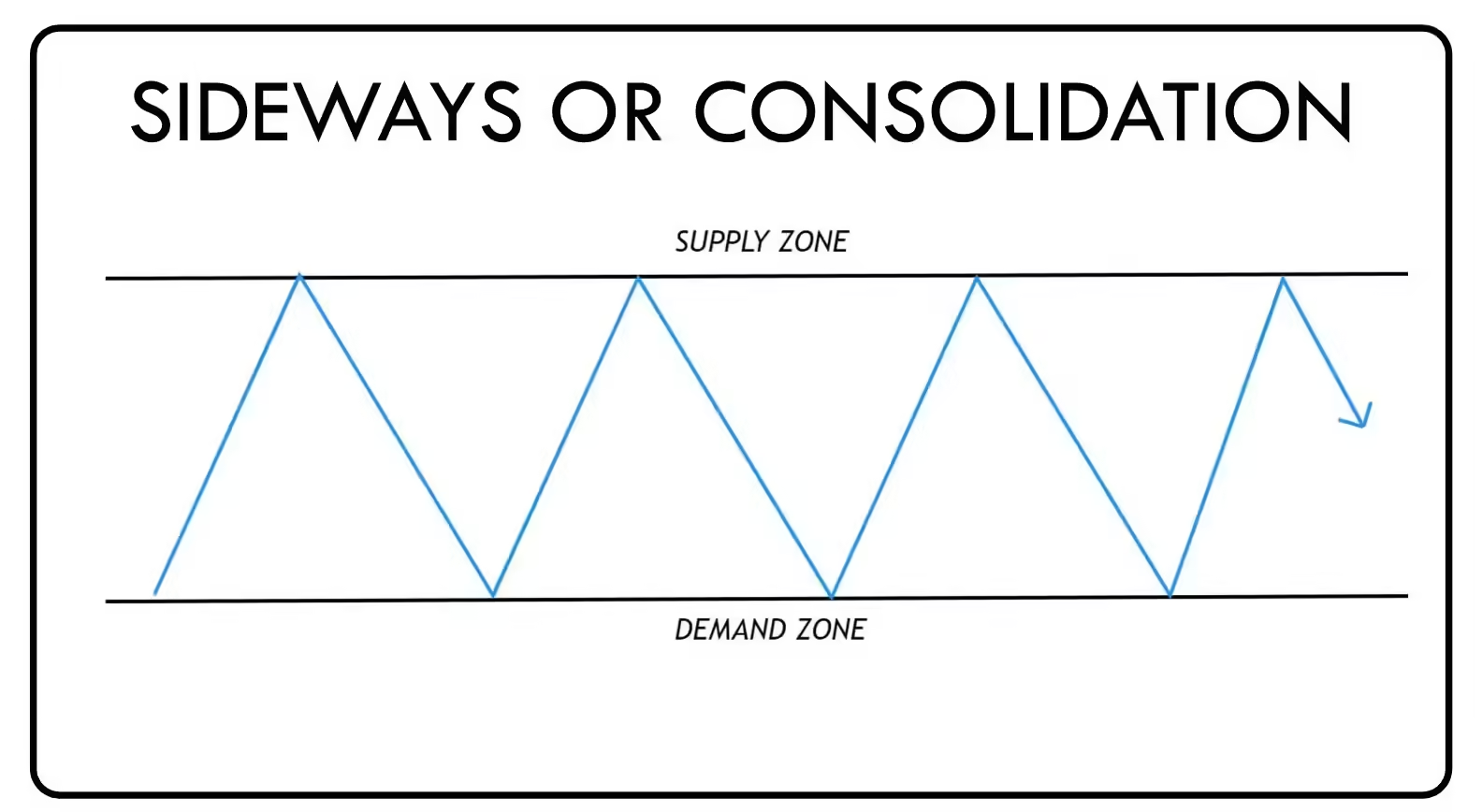

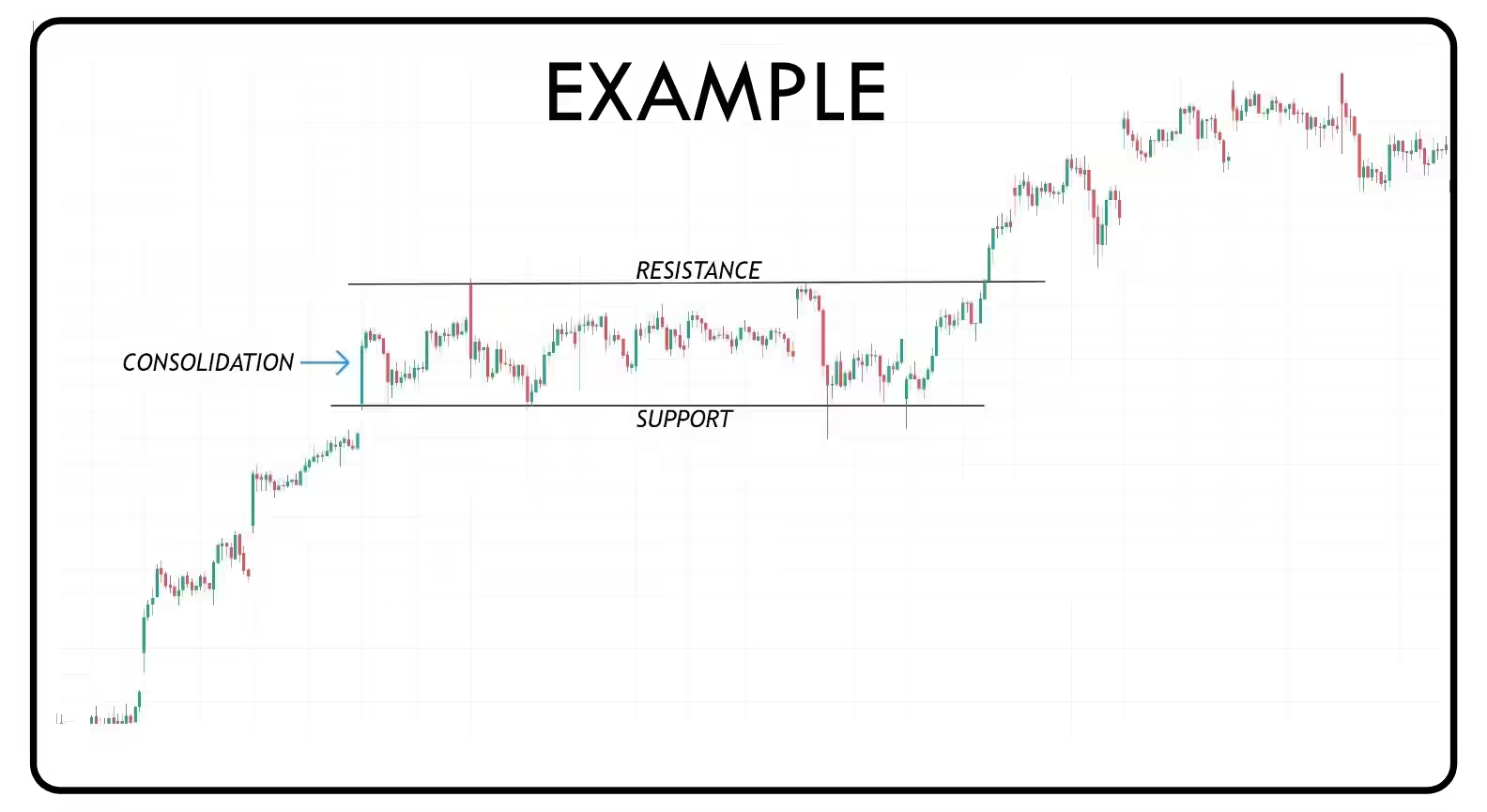

What is Consolidation?

Consolidation happens when the price moves sideways, meaning it stays in a small range and doesn’t go up or down much. During this time, buyers and sellers are waiting for a clear direction.

- Support and Resistance: The price moves between two levels. The lower level is called support (where the price stops falling), and the higher level is resistance (where the price stops rising).

- Breakout: After some time, the price will either break above resistance (go up) or break below support (go down), starting a new trend.

Simple Example:

Conclusion

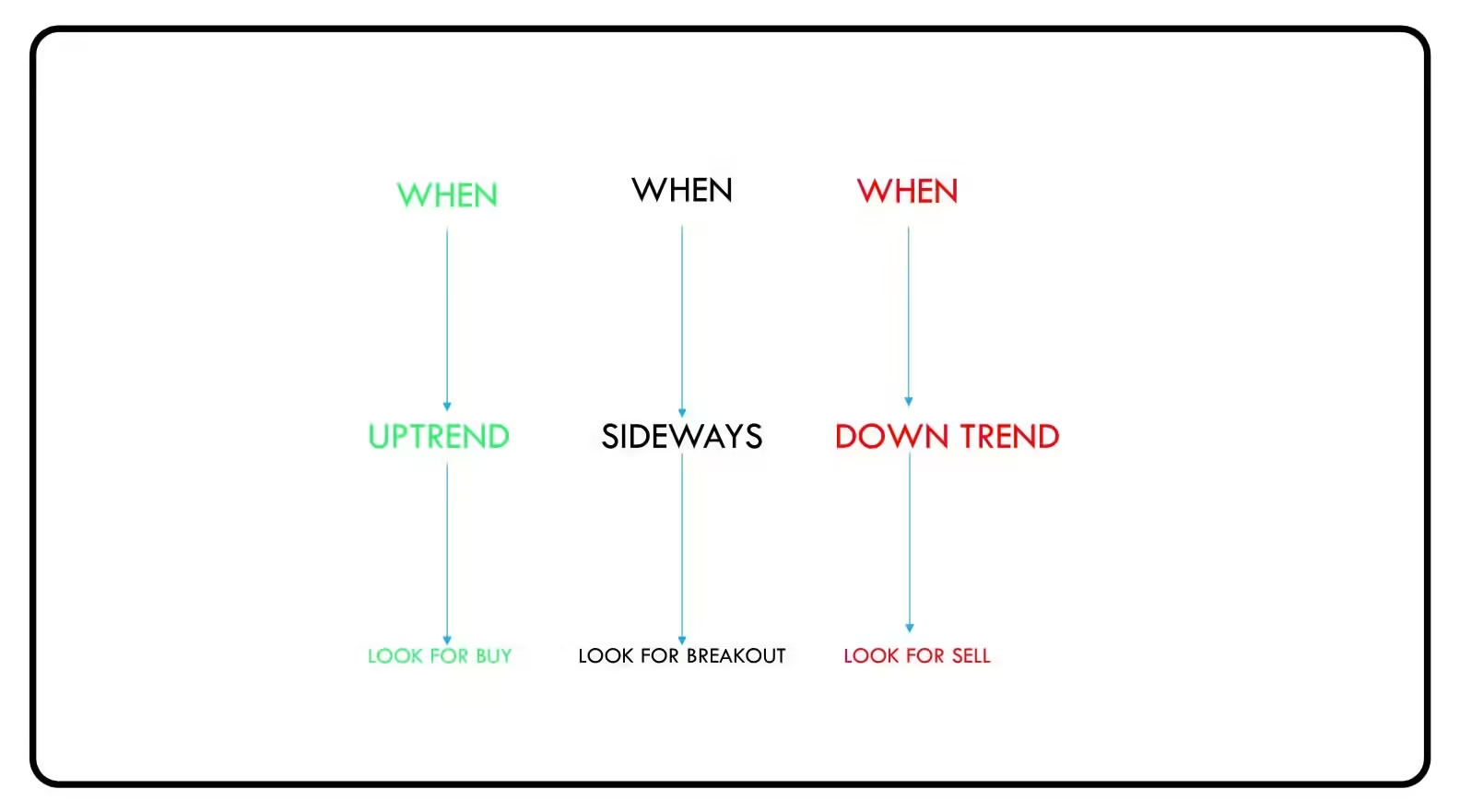

Understanding these patterns—downtrend, uptrend, and consolidation—can help us know when to buy or sell in the stock market. When prices are going down (downtrend), it’s usually a sign to be careful or sell. When prices are rising (uptrend), it’s a good time to buy or hold. And during consolidation, it’s best to wait and see which way the price will move next.

Learning these simple patterns will make it easier to understand how the market works and make better choices.